Protect your business and customers against cheques bounce

ChequesVerifier

ChequesVerifier

ChequesVerifier is a premium cheque payments security service designed to allow different businesses to have their cheques validated in near real time by issuing banks and banking experts.

This is to eliminate cheques bounce and fraud attempts.

Our validation scenarios take into consideration the different methods of fraud: cheque forgery, stolen checkbook, deceased checkbook owner, NSF cheques, invalid endorsements, certified cheque intercepts, unsettled past incidents and others.

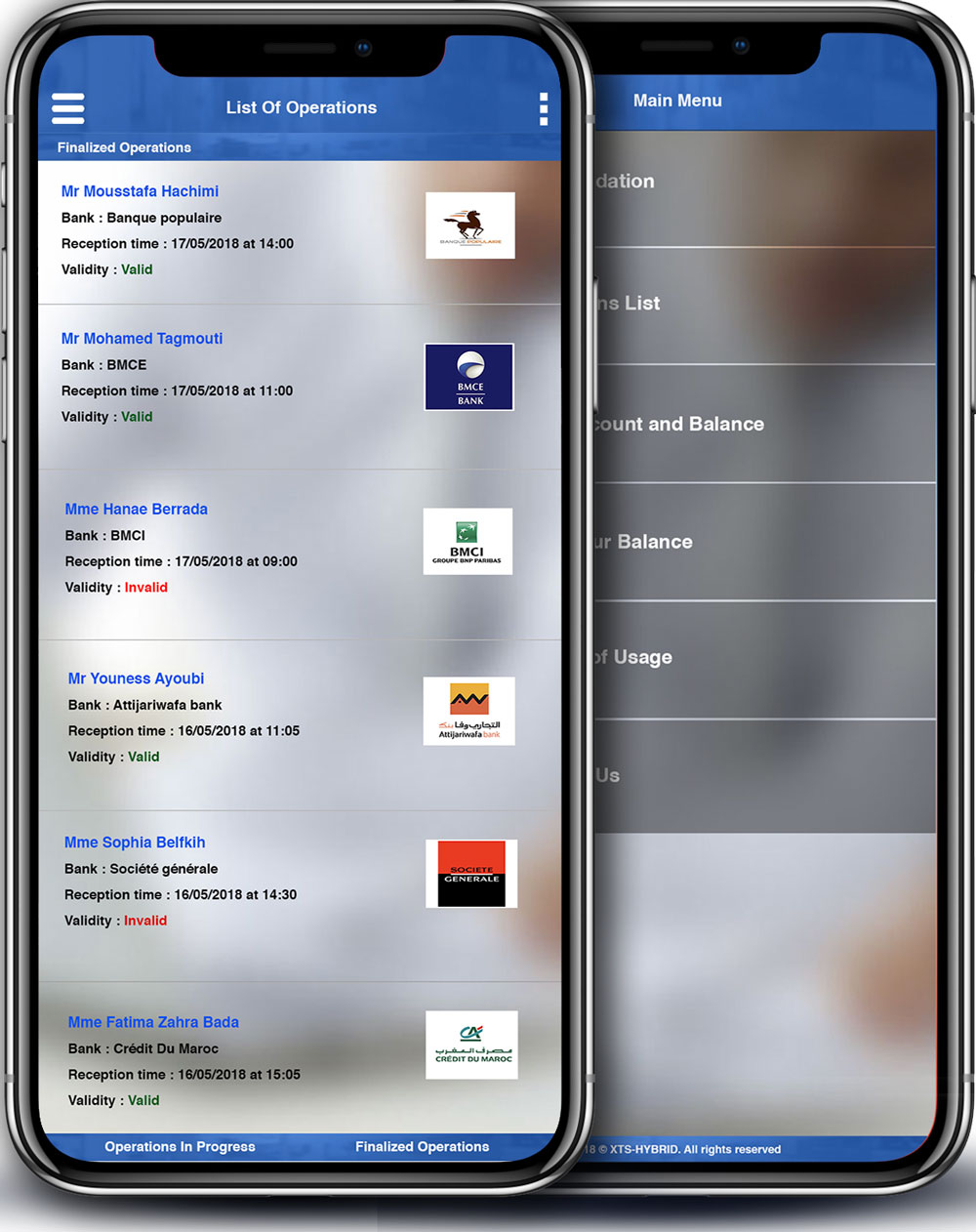

Live Verification

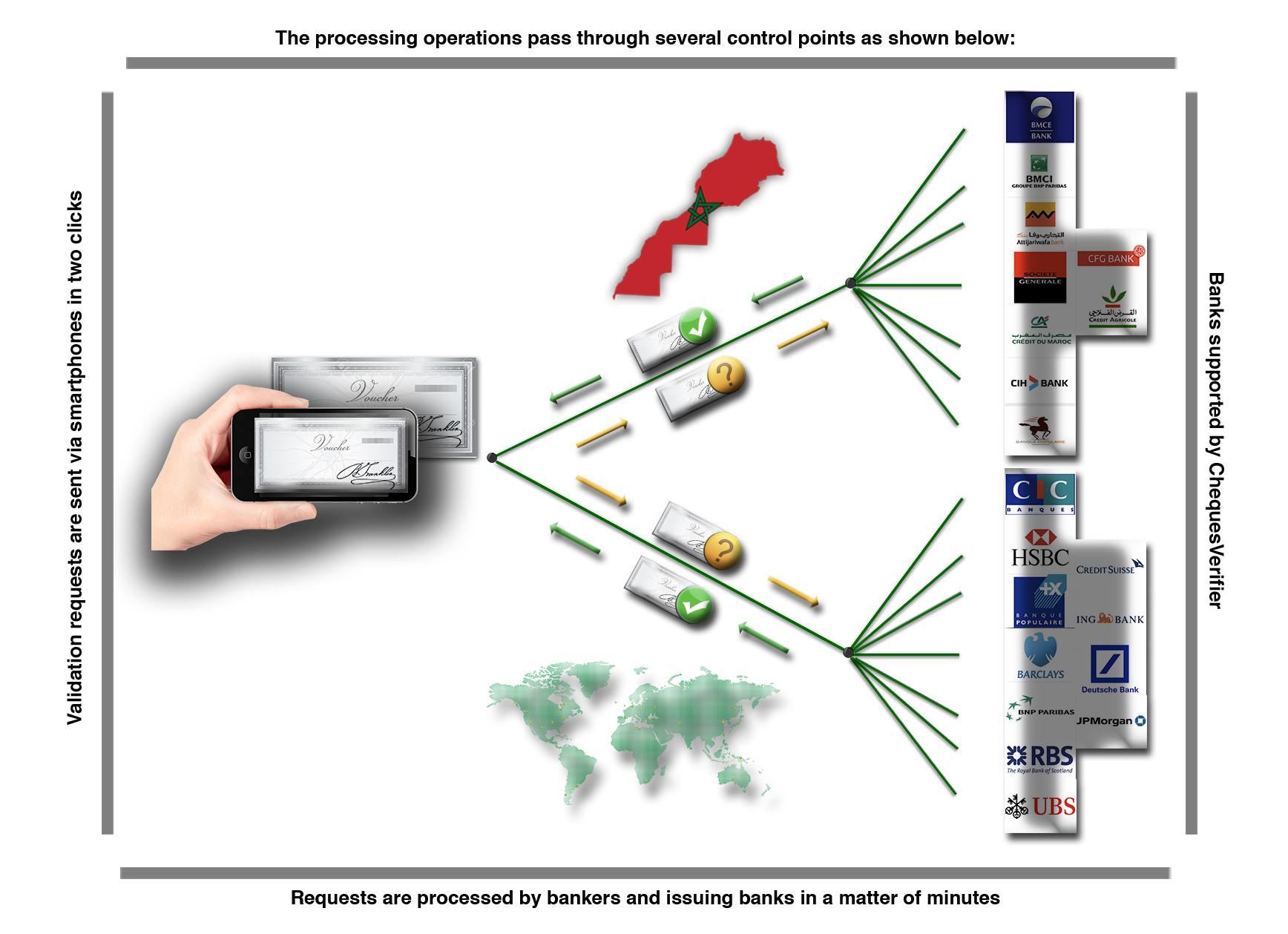

Our solution connects our customers, in near-real time, to all national banks as well as to all banks in several countries in Africa, Europe, Asia and North America. Validation demands processing starts the second of sending through our mobile application, and the responses are transfered in few minutes.

Our system allows our customers to send several requests at the same time and to follow the progress of their operations in real time.

Validation criterias

After receiving the requests, the issuing banks with our banking experts validate the cheques by respecting all security criterias:

The validity of the account (Open, blocked or closed)

The validity of the balance (Checks if the issuer has a sufficient fund)

Signature conformity (Useful in case of checkbook theft)

The validity of the physical check (If it is valid, falsified or stolen)

The conformity of handwritten elements noted on cheques

Analysis of scratches, discolorations, etc

past incidents not resolved by the same client

Approval of overloads and erasures

The absence of opposition

Plus other criterias